nebraska car sales tax form

The two taxes listed below are deductible but the wheel tax you paid is not. DAS Enrollment Application - DEALERS ONLY.

Tax Form Templates 5 Free Examples Fill Customize Download

State of Nebraska.

. Paying Taxes and Tire Fees. Form 6XN is available at each county treasurers office and the. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

The date of purchase is the earlier of two dates. The date on the motor vehicle title. Proof that sales or excise tax was paid.

Nebraska sales tax form. Department of Motor Vehicles. Electronic Lien and Title Name Change Addition Removal Request.

Businesses may become licensed to collect sales tax by filing a nebraska tax application form 20. The maximum tax that can be charged is 325 dollars. The Nebraska state sales and use tax rate is 55 055.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 75. Nebraska sales tax permit and must file a nebraska and local sales and use tax return form 10 on or before the due date. Transferee Buyer PLEASE PRINT.

32 Mbits Files in category. From the date of purchase and pay the Nebraska and local sales and use tax and the tire fee. All About Bills Of Sale In Nebraska The Forms And Facts You Need Pin On After Effects Animation Projects 1933 Vauxhall Light Six De Luxe Saloon Vauxhall Car Advertising British Cars Pin On Education Careers Infographics Car Engine Injector Wl02 13 H05 For Fuel Pump Parts Diesel Cars Cummins Car Engine.

After the application has been. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. Form 944 instructions 2021 how many nuclear bomb in north korea nebraska sales tax form.

Nebraska vehicle sales tax form. Qualified businessprofessional use to view vehicle. Application for Reissuance of Certificate of Title for a Classic Assembled Motor Vehicle.

Fee on this statement must be reported on an Amended Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6XN. Employer Identification Number EIN from the IRS or owners Social Security Number if a sole proprietorship with no employees. Nebraska Motor Vehicle Power of Attorney is required if a third party individual is registering the vehicle on behalf of the owner.

A 5 percent sales tax is imposed by Nebraska on all sales and use. Or the date of possession as evidenced by the Nebraska SalesUse Tax and Tire Fee Statement Form 6. Per the Nebraska DMV.

00208 Persons holding a sales tax permit may report and pay all use tax due on the Nebraska and Local Sales and Use Tax Return Form 10 or a Nebraska and Local Business Use Tax Return Form 2. Nebraska Sales Tax on Car Purchases. You can find these fees further down on the page.

Information needed to register a new business includes. The purchaser of a motor vehicle or trailer must present two copies of this statement to the county treasurer. From the above seller is exempt from the Nebraska sales tax as a purchase for resale rental or lease in the normal course of our business either in the form or condition in which purchased or as an ingredient or component part of other property to be resold.

SalesUse Tax and Tire Fee Statement for Motor Vehicle And Trailer Sales Submit this form to disclose the amount of sales tax and tire fees paid on a vehicle or trailer you purchased. 25000 for property damage. Must be ordered from the Nebraska Department of Revenue.

Form 6 SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales. Nebraska car sales tax form. Use a ballpoint pen to.

249 out of 1215 Download speed. 00209 Persons who are not required to hold. 18 is allocated to the city or village except that.

Transfer ownership of the motor vehicle described below. Nebraska Sales Tax Exemption kosiski 2016-07-26T1728140000. Municipal governments in Nebraska are also allowed to collect.

Blank tax nebraska vehicle sales form power of attorney form and cbsa print nj dmv form ba-49 Proof of Insurance. March 24 2022. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

The purchaser should retain their copy of this statement. Duplicate Certificate of Title Application. 25000 for bodily injury or death of one person.

Groceries are exempt from the Nebraska sales tax. The Nebraska state sales and use tax rate is 55 055. A sales tax permit can be obtained by registering for a Nebraska ID Number online or by mailing in the Nebraska Tax Application Form 20.

249 out of 1215 Download. The Motor Vehicle Tax is assessed on a vehicle at the time of initial registration and annually thereafter until the vehicle reaches 14 years of age or more. Sales Tax and Use Forms are referred to as Form 6 in Nebraska.

Acknowledge receipt of payment from and do hereby sell and. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Proof of Insurance with Minimum Requirements.

You must have. Individuals transacting a motor vehicle transfer of ownership must complete a Bill of Sale at the time of sale. Printable Nebraska Sales Tax Exemption Certificates Underpayment of sales or use tax or tire fee on this statement must be reported on an Amended Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6XN.

Get more for Nebraska Form 6. BILL OF SALE DATE OF SALE MODAYYEAR I in consideration of the payment of the sum of Transferor Seller PLEASE PRINT. The maximum local tax rate allowed by Nebraska law is 2.

Nebraska blank vehicle sales tax form Download Nebraska blank vehicle sales tax form Information. The vehicle identification number VIN. Nebraska is a state that taxes based on value which is deductible.

Certificate of Title Application. Form 6XN is available at each county treasurers office and DOR. Nebraska vehicle title and registration.

2022 annual tax sale procedures. Nebraska Sales Tax Exemption.

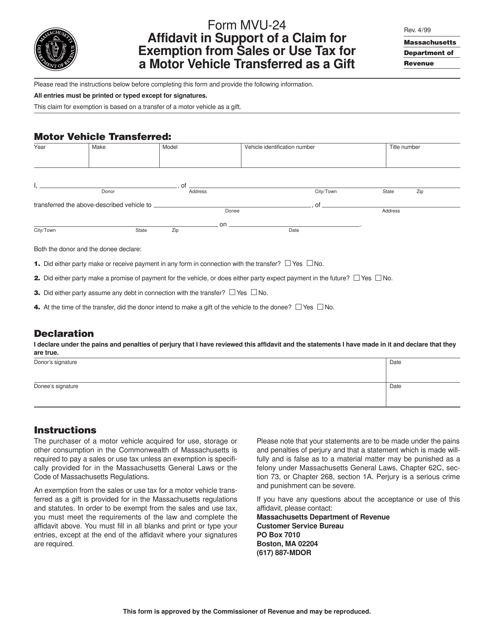

Form Mvu 24 Download Printable Pdf Or Fill Online Affidavit In Support Of A Claim For Exemption From Sales Or Use Tax For A Motor Vehicle Transferred As A Gift Massachusetts Templateroller

Form 13 Nebraska Fill Online Printable Fillable Blank Pdffiller

Oklahoma Tax Forms 2021 Printable State Ok 511 Form And Ok 511 Instructions

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Tax Form Templates 5 Free Examples Fill Customize Download

Schedule F Tax Form 1040 Instructions Farming Profit Loss

Tax Form Templates 5 Free Examples Fill Customize Download

Vehicles For Veterans Irs Car Donation Tax Information

Form 10 Fillable Nebraska And Local Sales And Use Tax Return With Schedule I Mvl And Instructions 10 2011

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

What Is A Schedule C Tax Form H R Block

Bill Of Sale Utah State Tax Commission Bill Of Sale Template State Tax Bills

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Irs Announces Standard Tax Deduction Increase For Tax Year 2022 To Adjust For Inflation

What Is Irp Plates Renewal Irs Forms Trucking Companies Renew

Ne Dor Form 6 2018 2022 Fill Out Tax Template Online Us Legal Forms

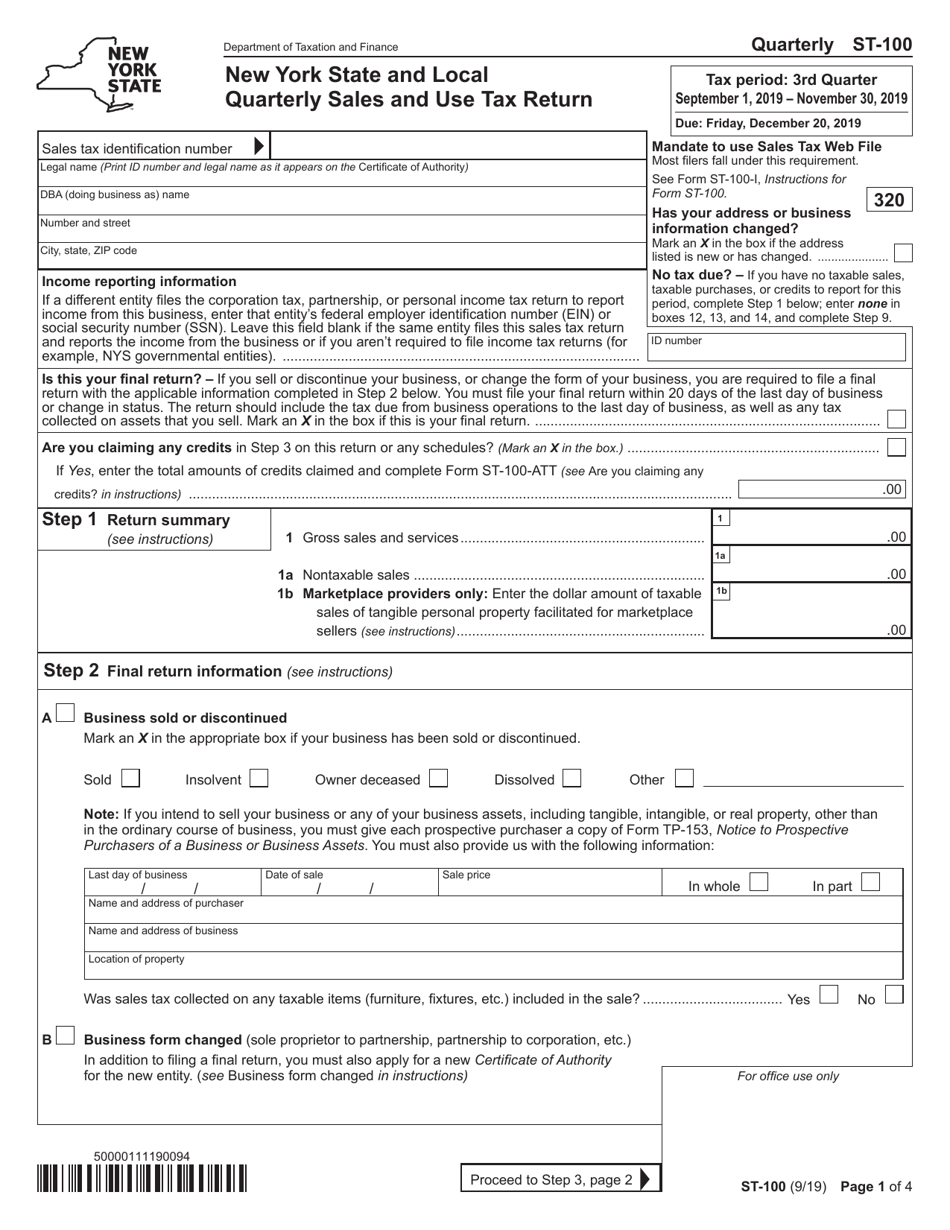

Form St 100 Download Printable Pdf Or Fill Online New York State And Local Quarterly Sales And Use Tax Return New York Templateroller

Tax Forms Form Information Business And Individual Taxpayers